Global Investment

SK Networks’s global investment activities aiming for an operation-based investment company

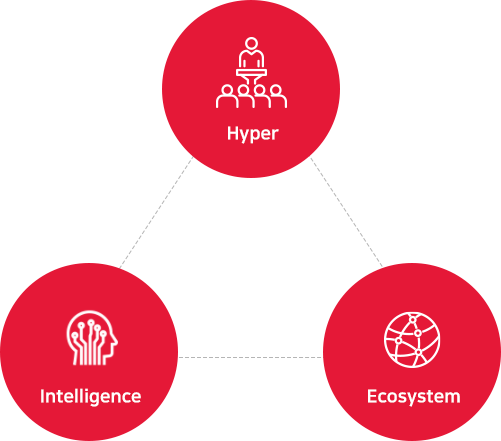

Investment Thesis

We aim to become an operation-based investment company, whose value is continuously raised through such investment activities. To this end, we explore global investment opportunities to identify future growth drivers and upgrade our existing business models.

Investment Domains

We selected three primary focus areas , considering our corporate philosophy, growth potential, and social impact.

-

Digital Transformation

Digital Transformation

Digital technologies make our lives convenient and smart. We invest in digital technologies that will bring about meaningful changes in society.

-

Web 3

Web 3

Web3 is characterized by security, decentralization, and transparency and can be applied in various industries. We invest in Web3 / blockchain-related areas in preparation for the future.

-

Sustainability

Sustainability

We pursue sustainable growth to create future value for all generations.

Network

Hicosystem is an inner circle network developed with early stage investment partners worldwide. It is driven by SK Networks.

- Startup Founder 149

- Investor 125

- Advisor 39

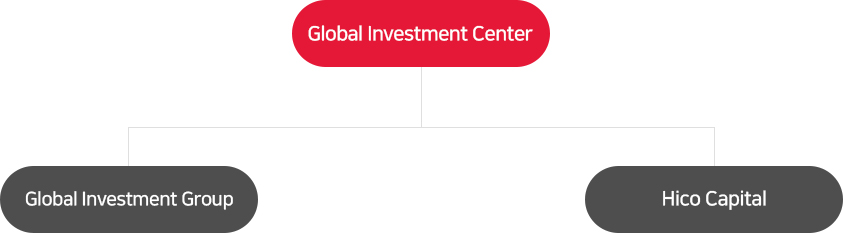

Team

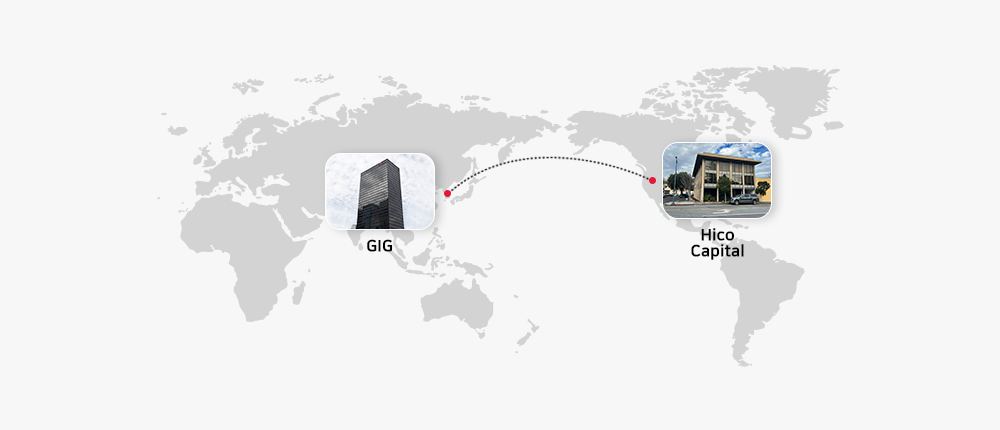

A multinational team with expertise is in charge of our global investments. Additionally, we have established an investment vehicle, Hico Capital, in Silicon Valley to enhance our network and proactively identify investment opportunities.

History

-

March 2018

First investment (Kurly*)

* IRR: 60%

(as of Jan. 2023) -

May 2020

Hico Capital established

(a subsidiary in U.S.)

-

November 2021

Fund Ⅱ launched

※ Fund Ⅰ IRR: 44%

(as of Jan. 2023)

Portfolio - direct investment

- 23 Total : 23

-

9

Direct Investment : 9

※ Kurly, PortOne, MycoWorks etc.

-

14

Fund Investment : 14

※SoftBank Future Innovation FundⅢ,

DCVC Bio FundⅡ, Kindred Ventures FundⅡ etc.